Three-Month CORRA Futures (CRA)

Underlying

Compounded daily Canadian Overnight Repo Rate Average ("CORRA") during the Reference Quarter.

Trading Unit

Compounded daily Canadian Overnight Repo Rate Average (CORRA) during the Reference Quarter, such that each basis point per annum of interest = $25 per contract. The contract size is C$2500 x Index.

Reference Quarter

Based on International Monetary Market ("IMM") dates. For a given contract, interval from (and including) the 3rd Wednesday of the Contract Reference Month, to (and not including) the 3rd Wednesday of the Delivery Month. The Contract Reference Month is different from the Delivery Month.

Contract Reference Month: For each contract, the Contract Reference Month is the month in which the Reference Quarter begins.

Delivery Month: For each contract, the Delivery Month is the month in which the Reference Quarter ends. Example for a June contract: The Reference Quarter starts on IMM Wednesday of June, the Contract Reference Month, and ends with Termination of Trading on the first business day before IMM Wednesday of September, the contract Delivery Month.

Expiry Cycle

Nearest twelve (12) quarterly contract months.

Price Quotation

Index: 100 - R.

R = the compounded daily CORRA for the Reference Quarter.

Minimum Price Fluctuation

- For the nearest listed contract month, the minimum price fluctuation is 0.0025, representing $6.25 per contract

- For all other contract months, the minimum price fluctuation is 0.005, representing $12.50 per contract

Contract Type

Cash-settled.

Last Trading Day

First business day preceding the 3rd Wednesday of the Delivery Month.

Final Settlement Price

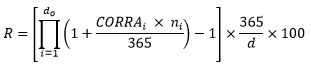

The final settlement price shall be 100 minus the compounded daily CORRA rate over the Reference Quarter. It is calculated in accordance with the following formula:

Where:

"do", the number of Business Days in the Reference Quarter;

"i" is a series of whole numbers from one to do, each representing the relevant Business Day in chronological order from, and including, the first Business Day in the relevant Reference Quarter;

CORRAi = Canadian Overnight Repo Rate Average ("CORRA") value calculated and representative of the ith day of the Reference Quarter;

"ni" is the number of calendar days in the relevant Reference Quarter on which the rate is CORRAi;

"d" is the number of calendar days in the relevant Reference Quarter.

Position Reporting Threshold

300 contracts.

Position Limit

- All-months position limit: not applicable.

- Spot month position limit: information can be obtained from the Regulatory Division as they are subject to periodic changes. See the position limits page on the Regulatory Division website.

Minimum Margin Requirements

Information on minimum margin requirements can be obtained from the Bourse as they are subject to periodic changes.

Trading Hours

Regular session: 2:00 a.m.** to 4:30 p.m.

Note: During early closing days, the regular session closes at 1:30 p.m.

** ± 15 seconds

Clearing Corporation

The Canadian Derivatives Clearing Corporation (CDCC).

MX Symbol

CRA

Trading strategies

- Hedging an expected change in the overnight repo rate target

- Predicting a change in the Canadian overnight repo rate target

- International spread between CRA and SR3 (CRA-SR3 spread)

- Yield Curve Strategy - Calendar Spread

The information contained in this document is for information purposes only and shall not be construed as legally binding. This document is a summary of the product's specifications which are set forth in the Rules of Bourse de Montréal Inc. ("Rules of the Bourse"). While Bourse de Montréal Inc. endeavors to keep this document up to date, it does not guarantee that it is complete or accurate. In the event of discrepancies between the information contained in this document and the Rules of the Bourse, the latter shall prevail. The Rules of the Bourse must be consulted in all cases concerning products' specifications.