December 6, 2022Advisory Notice A22-018

Listing of One-Month CORRA Futures (COA)

Bourse de Montréal Inc. (the "Bourse") wishes to inform market participants that it will list its new One-Month CORRA Futures Contract ("COA") on Monday, January 23, 2023, subject to the completion of the self-certification process established under the Derivatives Act and to obtaining any necessary final regulatory approvals. The launch of the COA contract further supports the benchmark transition efforts in Canada and is concurrent with the CORRA-first initiative for interbank linear derivatives announced by the Canadian Alternative Reference Rate ("CARR") Working Group and effective starting January 9th, 2023. More specifically, this new set of CORRA-based futures is expected to serve as key input for the development of a Term CORRA benchmark anticipated for Q3-2023.

In preparation for launch, the Bourse invites market participants and key stakeholders to test their systems. The new contract specifications can be found below.

The Bourse will list the nearest four calendar contract months, as well as intra-group strategies (spreads, strips, etc.) and inter-group strategies with 3M CORRA Futures ("CRA") contracts. The COA contract and related strategies opening time will be 2:00 am (ET), similar to the Bourse's other short-term interest rate futures (BAX and CRA product). See below for product specifications and more details.

The contracts will be added to the High Speed Vendor Feed (HSVF) and Order Book Feed (OBF) using the current messaging protocols three business days before the target launch date to allow vendors to refresh their dictionaries and data repositories. All information on the new contracts will be made available at www.m-x.ca on the first trading day.

GENERAL TEST ENVIRONMENT (GTE)

The One-Month CORRA Futures are currently available for testing in the GTE environment under the symbol COA.

C|O|A One-Month CORRA Futures

| SPECIFICATIONS | |

| Underlying | Compounded daily Canadian Overnight Repo Rate Average ("CORRA") during the Contract Month. |

| Trading Unit | Compounded daily Canadian Overnight Repo Rate Average (CORRA) during the Contract Month, such that each basis point per annum of interest = $25 per contract. The contract size is C$2500 x Index. |

| Contract Month | For each contract, the Contract Month corresponds to the settlement month. |

| Expiry Cycle |

Up to the nearest seven (7) monthly contract months. (Note: The initial listing (on January 23, 2023) will be the four (4) nearest contract months) |

| Price Quotation |

Index: 100 – R. R = the compounded daily CORRA for the Contract Month |

| Minimum Price Fluctuation |

0.0025 = C$6.25 for the nearest listed contract month 0.005 = C$12.50 for all other contract months |

| Contract Type | Cash-settled. |

| Last Trading Day | Last business day of the Contract Month |

| Final Settlement Price |

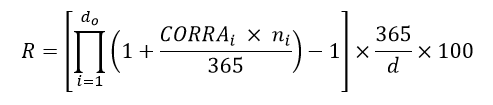

The final settlement price shall be 100 minus the compounded daily CORRA rate over the Contract Month. It is calculated in accordance with the following formula:

Where: "do", the number of Business Days in the Contract Month; "i" is a series of whole numbers from one to do, each representing the relevant Business Day in chronological order from, and including, the first Business Day in the relevant Contract Month; CORRAi = Canadian Overnight Repo Rate Average ("CORRA") value calculated and representative of the ith day of the Contract Month; "ni" is the number of calendar days in the relevant Contract Month on which the rate is CORRAi; "d" is the number of days from, and including, the first Business Day in the relevant Contract Month up to, and excluding, the first Business Day in the next calendar month. |

| Position Reporting Threshold | 300 contracts |

| Position Limit |

Information on position limits can be obtained from the Bourse as they are subject to periodic changes. See Circulars. |

| Minimum Margin Requirements |

Information on minimum margin requirements can be obtained from the Bourse as they are subject to periodic changes. See the Futures contracts margin rates page on the Regulatory Division website. |

| Trading Hours |

Regular session: 2:00** a.m.to 4:30 p.m. ET. Note: During early closing days, the regular session closes at 1:30 p.m. ** ± 15 seconds |

| Clearing Corporation |

The Canadian Derivatives Clearing Corporation (CDCC) |

| Ticker Symbol | COA |

The following One-Month CORRA Futures contracts will be listed at the open of trading on January 23, 2023.

| External Symbol | Contract Month | Last Trading day* |

| COAG23 | February 2023 | February 28, 2023 |

| COAH23 | March 2023 | March 31, 2023 |

| COAJ23 | April 2023 | April 28, 2023 |

| COAK23 | May 2023 | May 31, 2023 |

*Note: The final settlement price is calculated on the business day following the Last Trading day. The exposure period of the contract is from (and including) the first business day of the Contract Month to (and excluding) the first business day of the next calendar month.

One-Month CORRA Futures intra-group strategies will be available as of the open of trading on January 23, 2023. See below examples of strategies that will be listed.

| External Symbol | Strategy Component | Last Trading day |

| COAG23COAH23 | Buy 1 COAG23, Sell 1 COAH23 | February 28, 2023 |

| COAG23COAJ23 | Buy 1 COAG23, Sell 1 COAJ23 | February 28, 2023 |

| COAG23COAK23 | Buy 1 COAG23, Sell 1 COAK23 | February 28, 2023 |

| COAH23COAJ23 | Buy 1 COAH23, Sell 1COAJ23 | March 31, 2023 |

| COAH23COAK23 | Buy 1 COAH23, Sell 1 COAK23 | March 31, 2023 |

| COAJ23COAK23 | Buy 1 COAJ23, Sell 1 COAK23 | April 28, 2023 |

|

COAG2304 (4-month strip) |

Buy 1 (COAG23), Buy 1 (COAH23), Buy 1 (COAJ23), Buy 1 (COAK23) |

February 28, 2023 |

One-Month CORRA Futures inter-group strategies with CRA contracts will be available as of the open of trading on January 23, 2023. See below examples of inter-group strategies that may be listed.

| External Symbol | Strategy Component | Last Trading day |

| COAG23CRAZ22 | Buy 1 COAG23, Sell 1 CRAZ22 | February 28, 2023 |

| COAH23CRAZ22 | Buy 1 COAH23, Sell 1 CRAZ22 | March 14, 2023 |

| COAH23CRAH23 | Buy 1 COAH23, Sell 1 CRAH23 | March 31, 2023 |

| COAJ23CRAH23 | Buy 1 COAJ23, Sell 1 CRAH23 | April 28, 2023 |

| COAK23CRAH23 | Buy 1 COAK23, Sell 1 CRAH23 | May 31, 2023 |

|

1COAH3+1COAJ3+ 1COAK3-1CRAH3* |

Buy 1 (COAH23), Buy 1 (COAJ23), Buy 1 (COAK23), Sell 1 (CRAH23) |

March 31, 2023 |

*External symbol subject to change prior to listing.

Other One-Month CORRA Futures inter-group strategies with BAX contracts may be added eventually. See below example of a strategy structure in this case:

| External Symbol | Strategy Component | Last Trading day |

| COAG23BAXH23 | Buy 1 COAG23, Sell 1 BAXH23 | February 28, 2023 |

Note: For the intra-group and inter-group strategies mentioned above, the pricing is based on the prices and quantities of its constituents, and the implied pricing algorithm will be activated. For more details, please refer to the User Defined & Inter-Group Strategies or Implied pricing for Fixed Income Derivatives webpage.

For additional information on this notice, or if you require technical assistance, please contact the Market Operations' desk.

Market Operations

Toll-free: 1-888-693-6366

Local: 514-871-7871

Email: Monitoring@tmx.com

The information contained in this document is for information purposes only and shall not be construed as legally binding. This document is a summary of the product's specifications which are set forth in the Rules of Bourse de Montreal Inc. ("Rules of the Bourse"). While Bourse de Montreal Inc. endeavors to keep this document up to date, it does not guarantee that it is complete or accurate. In the event of discrepancies between the information contained in this document and the Rules of the Bourse, the latter shall prevail. The Rules of the Bourse must be consulted in all cases concerning product's specifications.

© 1996-2022 Bourse de Montréal Inc. 1800 - 1190 Avenue des Canadiens-de-Montréal P.O. Box 37 Montréal (Québec) H3B 0G7, Canada