Slightly Different BA Contract, Same Story?

BAX Markets Often Overly Hawkish1

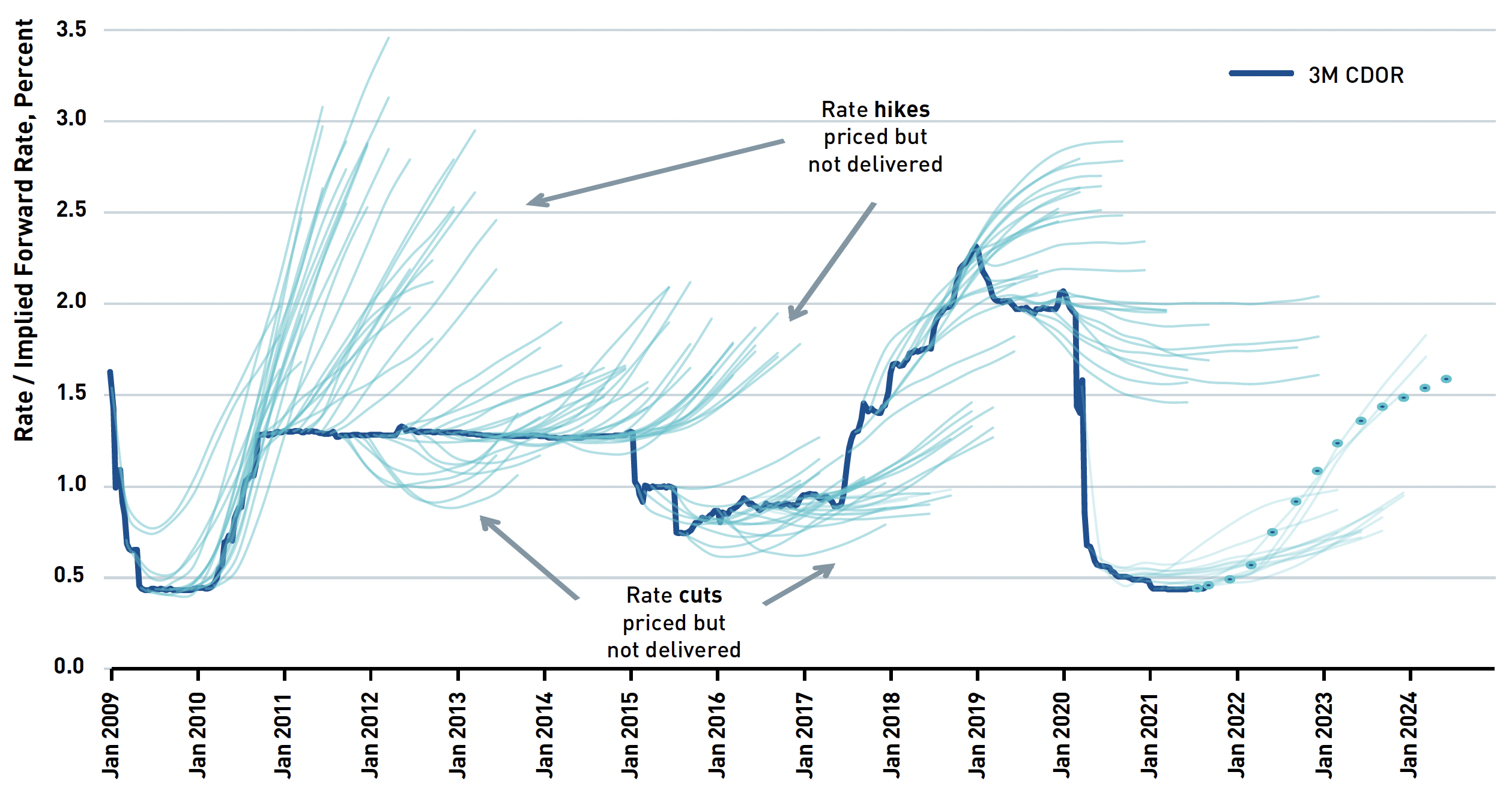

Since 2009, Three-Month Canadian Bankers' Acceptance Futures markets have predicted Bank of Canada rate hikes that have often not been realized2. Sometimes, despite dovish rhetoric and actions by the Bank of Canada, the curve of 90-day rates in Canada has continued to predict more increases to the target rate than the Bank of Canada has been prepared to deliver.

To demonstrate the above observation, we periodically publish analysis and observations based on the graphical depiction of 90-day rates in Figure 1, which we have updated to the end of August 2021. In the chart, the "spaghetti lines" depict the yield curve for 90-day CDOR3 futures contracts (BAX) on Montréal Exchange as captured each month since January 2009, the beginning of the recovery from the 2008 financial crisis. The solid line shows the level of CDOR4 on each date, so this visualization allows us to easily compare the implied yield from the futures contract to the level of CDOR that was eventually realized. CDOR, of course, closely follows the Bank of Canada target rate which anchors the front end of the Canadian yield curve.

In Figure 1, yield curves above the solid CDOR line depict periods when the futures market anticipated, via lower prices (higher yields) for BAX, short-term interest rate hikes that were not delivered by the Bank of Canada. Similarly, yield curves below the solid CDOR line depict periods when the market anticipated short-term interest rate declines or cuts that were not delivered by the Bank. Obviously, there are many more periods when the futures market has been overly hawkish about the Bank of Canada increasing short-term interest rates than the opposite.

FIGURE 1

CDOR and Monthly BAX Curves, Jan 2009 to Present

Source: BMO Capital Marketsi Fixed Income Sapphire database, Montréal Exchange

Current Situation

The BAX market has been fairly accurate of late, anticipating reasonably well for the year between March 2020 and March 2021 that the Bank of Canada would make no change to the target rate (yield curve lines close to the solid CDOR line). However, the market has, since the beginning of summer, once again begun to anticipate a more active central bank and an eventual return to active monetary policy.

The highlighted curve in Figure 1 depicts the BAX curve at the end of August 2021 which anticipates a series of about three rate hikes, not immediately but starting in 2022, although the curve has come down somewhat from earlier in August. This situation, although far from extreme in terms of hawkish anticipation, appears similar to the situation in 2009 when the Canadian economy was emerging from the last crisis; a series of rate hikes anticipated by the front-end of the yield curve but accompanied by a much more tentative central bank. More specifically, BAX anticipated a rise to 2.5% to 3% CDOR yields as the Bank of Canada was tentatively raising rates in 2010 from 0.5% to 1.25%; a series of just three 25 basis point rate hikes as opposed to the ten 25 basis point rate hikes that the BAX market predicted on some dates. During this period, the maximum year-on-year increase in CDOR was 87 basis points while the maximum year-on-year increase in the BAX markets' pricing for that rate was a much more substantial 202 basis points5, leaving a lot of room for trading profits.

Improved Composition of BAX

We should note that BAX futures contracts have changed significantly in the past 12 years. A few modifications to the contract specifications6 and a wider adoption by local and international participants successfully developed liquidity in the product; the average daily volume is about three times higher now than in 2009.

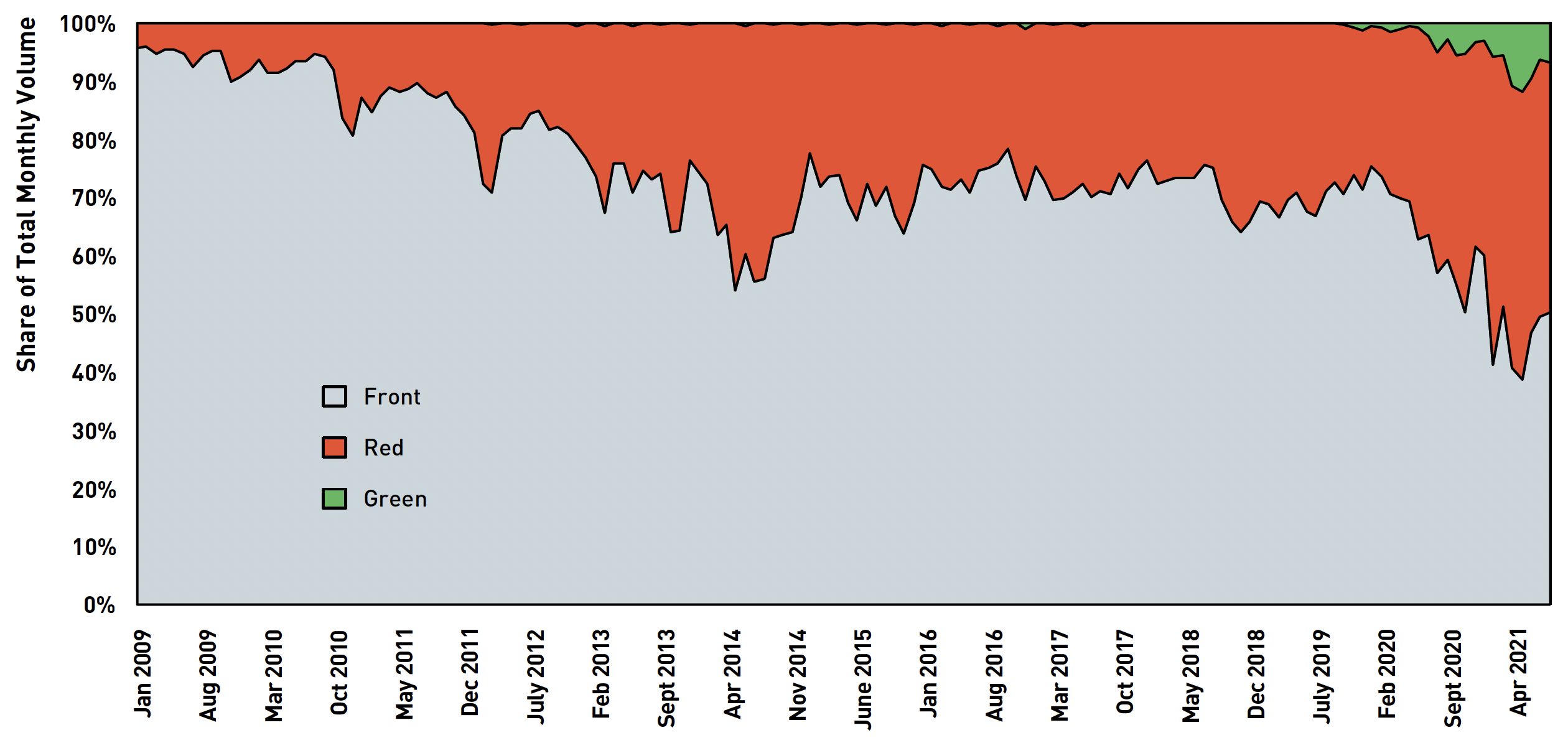

Additionally, as shown in Figure 2, 96% of all the contract volume was in the front contracts (the first four quarterly expiry dates), in 2009. In 2021, just 50% of the BAX contract volume is in front contracts and red contracts (the next four expiry dates, or the second year of expiries) consist of about 40%. Even green contracts (the four expiry dates that follow the red contracts, or the third year of expiries) have begun to trade actively given the longer forward-looking view necessary to speculate on or hedge future moves in short-term interest rates at this time.

Each of these developments has improved the BAX contract as an instrument for speculators and hedgers with interest in the front end of Canada's yield curve. A great complement to BAX is the addition of CORRA futures (CRATM), which offer a pure instrument7 for speculating on future moves in the overnight rate, but for now, liquidity and trading in the short-term interest rate derivative markets in Canada still focus on BAX futures.

FIGURE 2

BAX Volume by Series, Jan 2009 to Present

Source: Montréal Exchange

Trading Strategies

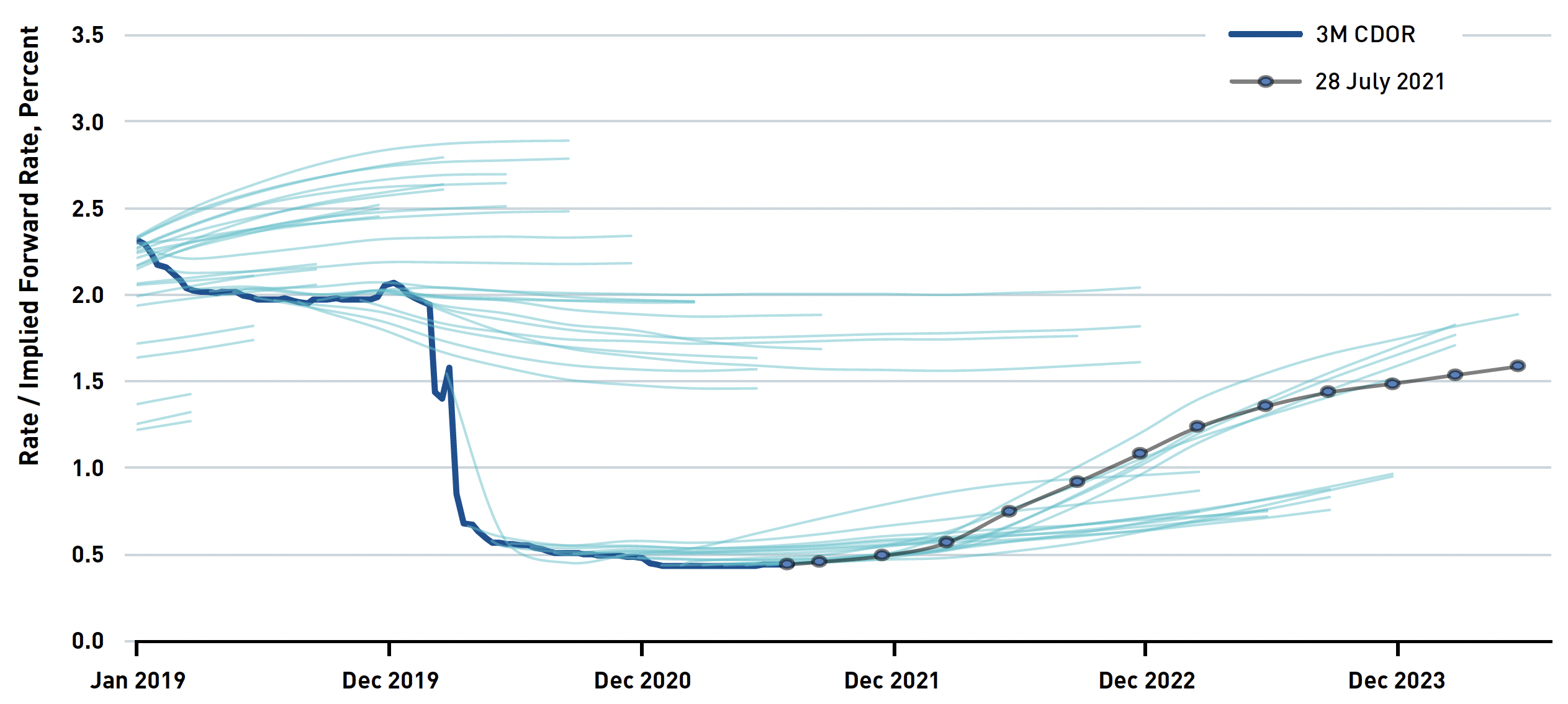

Although we always recommend clients do their own extensive analysis before trading, we note that in Figure 3, which depicts the BAX curves since the start of 2019 to present and highlights the most recent curve at the end of August 2021, the curve is most steep between March 2022 and December 2022 at 68 basis points.

FIGURE 3

August 2021 BAX Curves, Since Jan 2019

Source: BMO Capital Marketsi Fixed Income Sapphire database, Montréal Exchange

We group Portfolio Managers into three categories currently with respect to BAX strategies.

Patient Managers

A patient manager will probably choose to wait until the recovery is well underway and for BAX prices to imply unrealistic activity by the Bank of Canada, such as has periodically happened in the past and which we expect will materialize again. Most observers recognize that the 2020 pandemic market was/is at least as bad for Canada as the 2008 financial crisis so if the BAX curve begins to price monetary policy more hawkish than the Bank of Canada implemented coming out of that crisis, managers that have waited patiently for markets to imply such aggressively hawkish monetary policy will likely see abundant opportunities to buy cheap BAX contracts.

The drawback for the patient manager is that most front-end yield curve strategies must be put on the backburner for months at this time. Additionally, there is always the possibility that the front-end never prices unrealistic Bank policy, as it did in 2009 and 2010 when Canada began to exit the previous recession.

Impatient Managers

Impatient managers are, by definition, we think, managers with a higher risk tolerance than patient managers. Some will be inclined to play BAX in both directions as Canada begins its recovery and will enter short positions on BAX in anticipation that the front-end of the curve will soon move to unrealistic implied Bank policy as it often has done in the past. Steepening positions could be entered at the current 68 basis points in the expectation that contracts will eventually price 100-200 basis points of monetary policy tightening.

The drawback here is that anticipating when the market will begin to price unrealistic rate hikes is difficult. Many of these managers will be trend following and should be watching for breakout moves to lower prices in BAX (higher yields, more hawkish implied monetary policy). If BAX behaves as it usually has in the past, the implied yield on the contracts will rise too far and too fast as the country begins to recover, giving an opportunity to eventually close and reverse bearish positions. If managers follow this path, they should be vigilant watching for the end of the trend and remain nimble enough to close and reverse positions as implied policy becomes unrealistic, assuming BA contracts overshoot as they have in the past.

Bulletproof Managers

A bulletproof manager may choose to enter BAX positions today given that the reward and the likelihood of it happening is far greater than the risk to expiry of the contracts. At a difference of perhaps 70 basis points, depending on the contract pair traded in a flattener, and 87 basis points maximum annual CDOR rise in the recovery from the GFC implies a gain of 70 basis points versus a potential loss of just 17 basis points (entry at 70, CDOR rises 87 basis points in a year as in the last recovery).

Managers that consider themselves bulletproof should keep in mind that, although the Bank of Canada delivered only three rate hikes for a total of 75 basis points in its most aggressive calendar year when the economy began to emerge from the last crisis, the market implied a great deal more at times, which would cause these positions to mark heavily against a portfolio in the interim period. In short, while BAX flattening (or long) trades entered too early may be successful at expiry, there often is no one left to celebrate as the market moves so far against early flattening positions that all but the most resilient portfolios have stopped out.

For more information, sign up to receive the latest news and updates or contact us.

Read more about Institutional Content m-x.ca/futures

1 A methodology and calculator to derive interest rate expectations from BAX prices can be found here.

2 For a more full discussion of this topic, interested readers can refer to "Evolving BAX: Nearly a Decade of Easy Rolldown" published by Montréal Exchange in November 2017 and updated in October 2019.

3 3-month CDOR, the 90-day Canadian Dollar Offered Rate, is directly linked to the final settlement price for the BAX futures contracts, which is "100 – 3-month CDOR" on the expiry day.

4 In this article, for convenience purposes, the term "CDOR" represents the benchmark 3-month CDOR rate.

5 BA contracts and BA rates contain a small credit element so our simplified method of simply subtracting one implied contract yield from another is not completely correct. However, a long position would have profited by the credit rolldown so, while target rate predictions are only an approximation, profit calculations are correct.

6 The most notable one being the reduction of the minimum price fluctuation from 0.01 to 0.005, which the Montréal Exchange implemented in three phases between 2014 and 2020 (except for the front month contract which was already trading in 0.005 increments since 2002).

7 CORRA contracts do not contain the small amount of embedded credit associated with BAX and CDOR.

About the author:

Kevin Dribnenki

Kevin Dribnenki writes about fixed income derivatives and opportunities in Canadian markets. He spent over 10 years managing fixed income relative value portfolios as a Portfolio Manager first at Ontario Teachers' Pension Plan and then BlueCrest Capital Management. During that time he managed domestic cash bond portfolios as well as international leveraged alpha portfolios and has presented at several fixed income and derivatives conferences. He received a BA in Economics from the University of Victoria, an MBA from the Richard Ivey School of Business, and holds the Chartered Financial Analyst designation.Follow Kevin on LinkedIn

i BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking business of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Ireland plc., and Bank of Montreal (China) Co. Ltd and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada and Asia and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in Europe and Australia. "BMO Capital Markets" is a trademark of Bank of Montreal, used under license.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.'s prior written consent. This information is provided for information purposes only. The views, opinions and advice provided in this publication reflect those of the individual author. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities or derivatives listed on Montreal Exchange, Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. BAX, Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. and are used under license.

THE BAX (THE "PRODUCT") IS NOT SPONSORED, ENDORSED, SOLD OR PROMOTED BY THOMSON REUTERS CANADA LIMITED OR ANY OF ITS SUBSIDIARIES OR AFFILIATES ("THOMSON REUTERS"). THOMSON REUTERS MAKE NO REPRESENTATION OR WARRANTY, EXPRESS OR IMPLIED, TO THE OWNERS OF THE PRODUCT OR ANY MEMBER OF THE PUBLIC REGARDING THE ADVISABILITY OF INVESTING IN SECURITIES GENERALLY OR IN THE PRODUCT PARTICULARLY OR THE ABILITY OF CDOR (THE "BENCHMARK") TO TRACK GENERAL MARKET PERFORMANCE. THOMSON REUTERS ONLY RELATIONSHIP TO THE PRODUCT AND THE BOURSE DE MONTREAL INC. (THE "LICENSEE") IS THE LICENSING OF THE BENCHMARK, WHICH IS ADMINISTERED, CALCULATED AND DISTRIBUTED BY THOMSON REUTERS WITHOUT REGARD TO THE LICENSEE OR THE PRODUCT. THOMSON REUTERS HAS NO OBLIGATION TO TAKE THE NEEDS OF THE LICENSEE OR THE OWNERS OF THE PRODUCT INTO CONSIDERATION IN CONNECTION WITH THE FOREGOING. THOMSON REUTERS IS NOT RESPONSIBLE FOR AND HAS NOT PARTICIPATED IN THE DETERMINATION OF, THE TIMING OF, PRICES AT, OR QUANTITIES OF THE PRODUCT TO BE ISSUED OR IN THE DETERMINATION OR CALCULATION OF THE EQUATION BY WHICH THE PRODUCT IS TO BE CONVERTED INTO CASH.

THOMSON REUTERS HAS NO OBLIGATION OR LIABILITY IN CONNECTION WITH THE ADMINISTRATION, MARKETING OR TRADING OF THE PRODUCT. THOMSON REUTERS DOES NOT GUARANTEE THE QUALITY, ACCURACY AND/OR THE COMPLETENESS OF THE BENCHMARK OR ANY DATA INCLUDED THEREIN. THOMSON REUTERS MAKE NO WARRANTY, EXPRESS OR IMPLIED, AS TO RESULTS TO BE OBTAINED BY LICENSEE, OWNERS OF THE PRODUCT, OR ANY OTHER PERSON OR ENTITY FROM THE USE OF THE BENCHMARK OR ANY DATA INCLUDED THEREIN. THOMSON REUTERS MAKE NO EXPRESS OR IMPLIED WARRANTIES, AND HEREBY EXPRESSLY DISCLAIMS ALL WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE OR USE WITH RESPECT TO THE BENCHMARK OR ANY DATA INCLUDED THEREIN. WITHOUT LIMITING ANY OF THE FOREGOING, IN NO EVENT SHALL THOMSON REUTERS HAVE ANY LIABILITY FOR ANY DAMAGES OF ANY KIND, INCLUDING WITHOUT LIMITATION, LOST PROFITS, SPECIAL, PUNITIVE, INDIRECT, INCIDENTAL OR CONSEQUENTIAL DAMAGES, EVEN IF NOTIFIED OF THE POSSIBILITY OF SUCH DAMAGES.