Launch of 30-Year Canadian Bond Futures

Market Makers

- National Bank Financial

- Desjardins Securities

Benefits

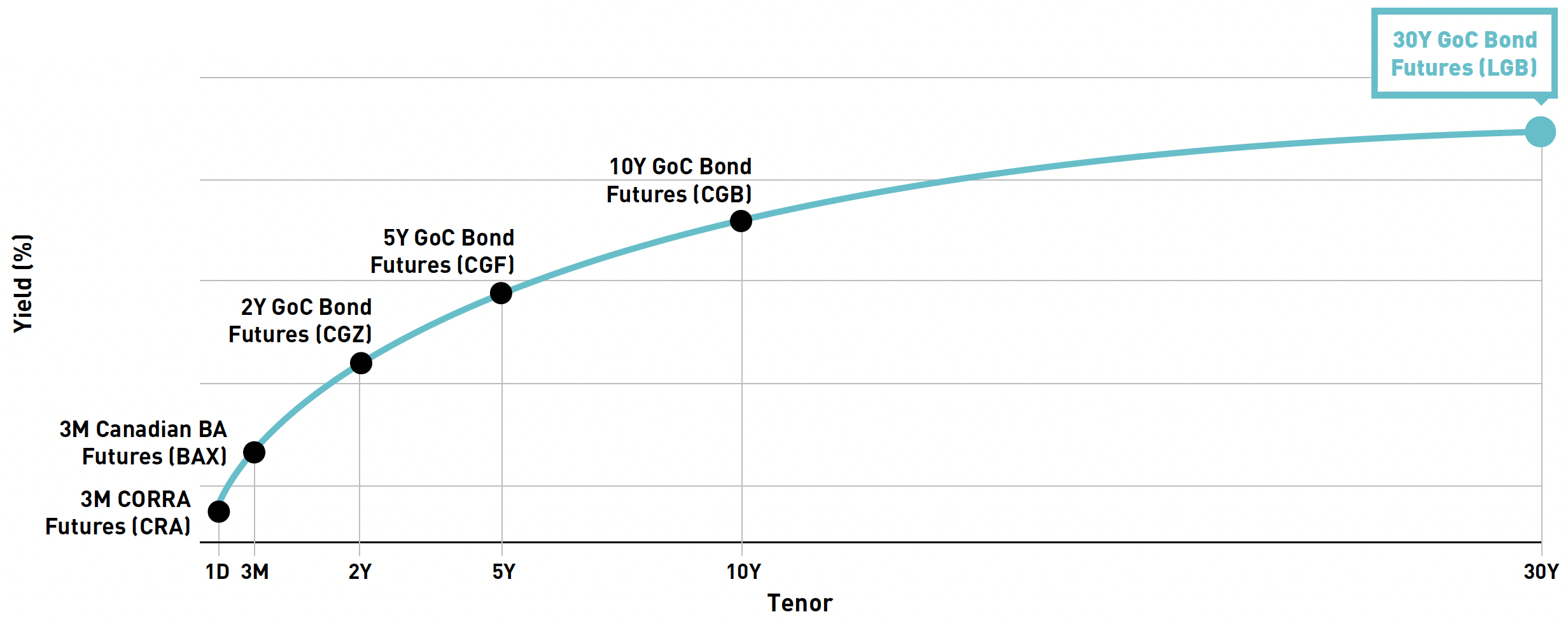

- Increased number of liquid points on the Canadian listed yield curve

- Facilitate hedging for longer maturity instruments

- Enhance cross-market trade opportunities

- Enable more trading strategies alongside the 2Y/5Y/10Y GoC bond futures contracts

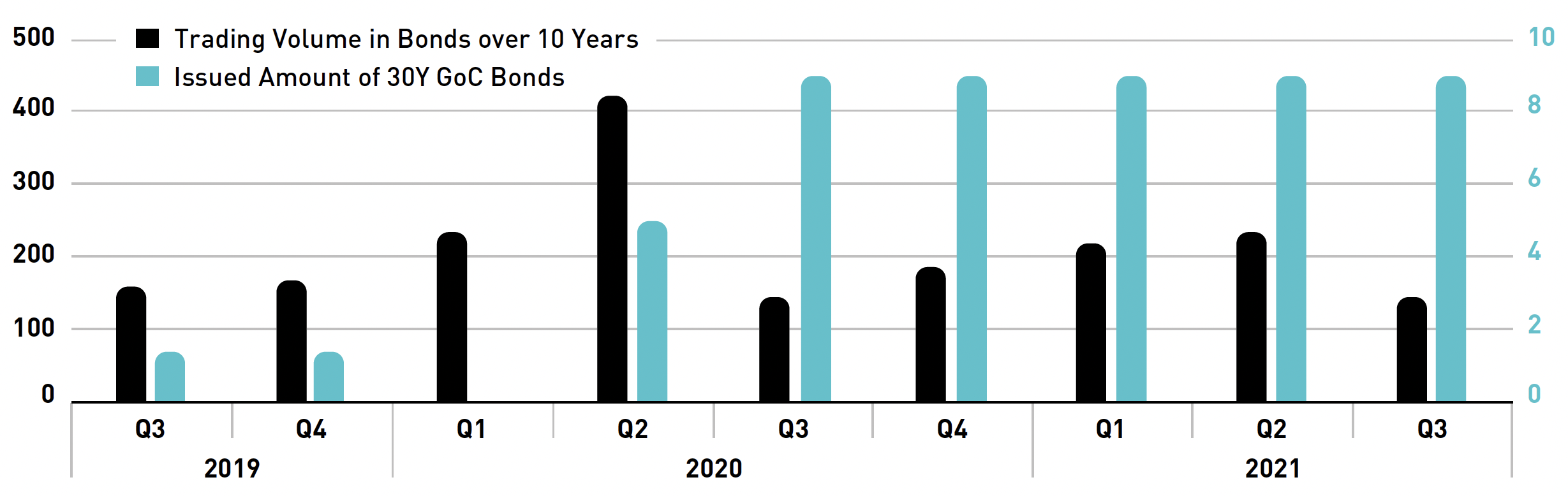

Liquidity development supported by strong underlying market

- Significant daily activity in underlying cash 10Y+ segment (ADV of C$3B, Sep YTD)

- Record 30Y GoC bond issuances lead to more trading opportunities and risk management needs

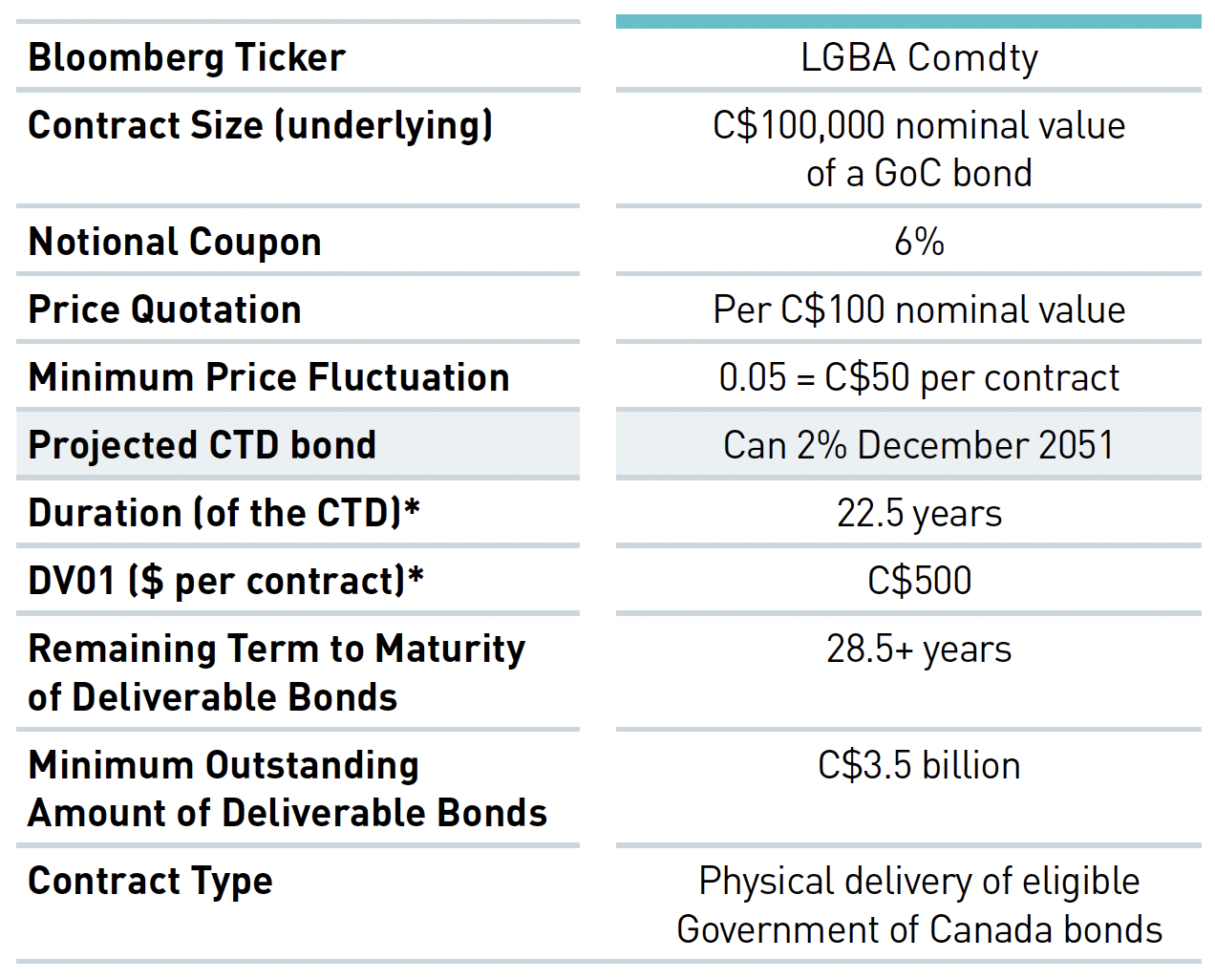

Key Contract Specifications

* Indicative level

GoC Bond Trading and Issuance (in C$B)

Source: IIROC and Bank of Canada statistics

Trading Strategies & Uses

Along with the flagship 2-year, 5-year and 10-year Government of Canada bond futures (CGZ, CGF and CGB), LGB is a cost-efficient and simple way to:

- Manage interest rate risk, duration and portfolio risk profiles

- Hedge GoC bond holdings

- Replicate synthetic bond positions (long or short)

- Trade yield spread between countries

- Canadian credit spread trades

- Basis and invoice spread strategies

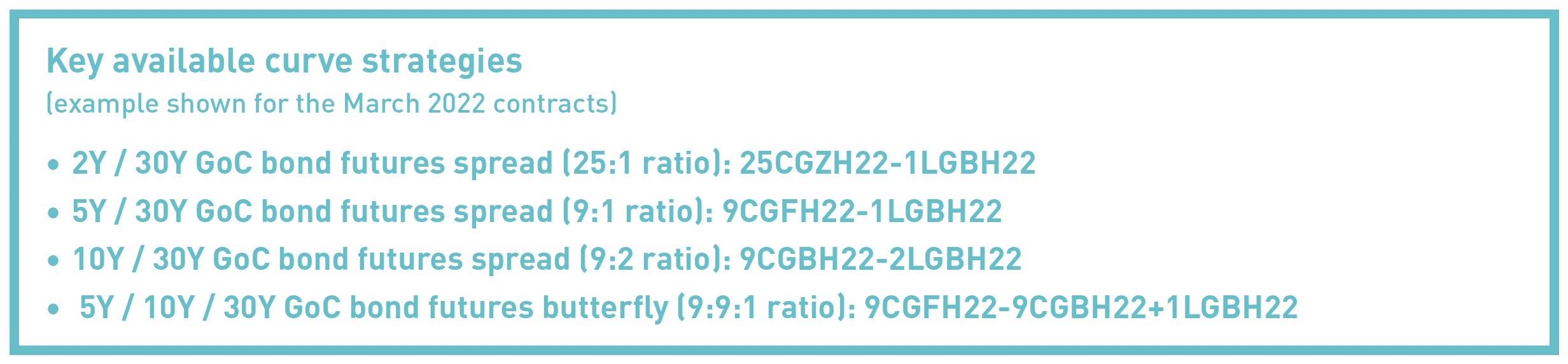

Curve Trades

- Ability to trade curve spread strategies against CGZ, CGF or CGB in a single transaction via the Inter-Group Strategy (IGS) functionality

- Trade using a predefined ratio, reducing inherent execution risk

- Ex: 10Y / 30Y GoC bond futures spread ratio: 9CGB-2LGB

- Strategy pricing: (Listed leg1 ratio x Leg1 price) - (Listed leg2 ratio x Leg2 price)

- Implied pricing algorithm allows outright quotes to imply orders in the spread book, and quotes in the spread book to imply into the respective outright order books

Canadian Listed Yield Curve

For more information, sign up to receive the latest news and updates or contact us.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities or derivatives listed on Montreal Exchange, Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. CGB, CGF, CGZ, LBG, Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. and are used under license.