30-Year Government of Canada Bond Futures (LGB): A Primer for CGB Users

The launch of the 30-Year Government of Canada Bond Futures (LGB) will bring a much-anticipated liquidity point to the futures curve in Canada. As the contract specifications will be very similar to the 10-Year Government of Canada Bond Futures (CGB), users of CGB should be able to quickly adapt to using the new contract. In this paper, we point out some characteristics of the LGB contract that users of CGB may want to take note of before trading the 30-year contract.

Very Long Term to Maturity

The LGB contract delivery basket consists of Canadian bonds having a maturity greater than 28.5 years which, perhaps it goes without saying, means the contract will be a substitute for very long maturity bonds, normally either the current benchmark long bond in the cash market, the previous benchmark1, or even the auction bond2. Any of these bonds as the cheapest-to-deliver means that there should be no shortage of bonds to deliver.

For the initial contracts3, the delivery basket consists of the Canada 2% December 2051 and 1.75% December 2053 bonds with the 2051 as the likely cheapest-to-deliver (CTD) bond. The 2051 is the current long bond benchmark and the 2053 is the current auction bond. The former has a pandemic-related massive notional outstanding of almost $52 billion while the 2053 has built already to over $11 billion notional and continues to grow.

Extension Tension?

The bonds available for the delivery basket are a function of the financing needs of the federal government and the bond issuance policy driven by those financing needs. In the past 30 years, that policy has changed infrequently. It was formerly a new bond every two years, then was changed to a new bond maturity every four years, then was reduced to every three years and is currently back at a new bond maturity being created in the long end of the yield curve every two years.

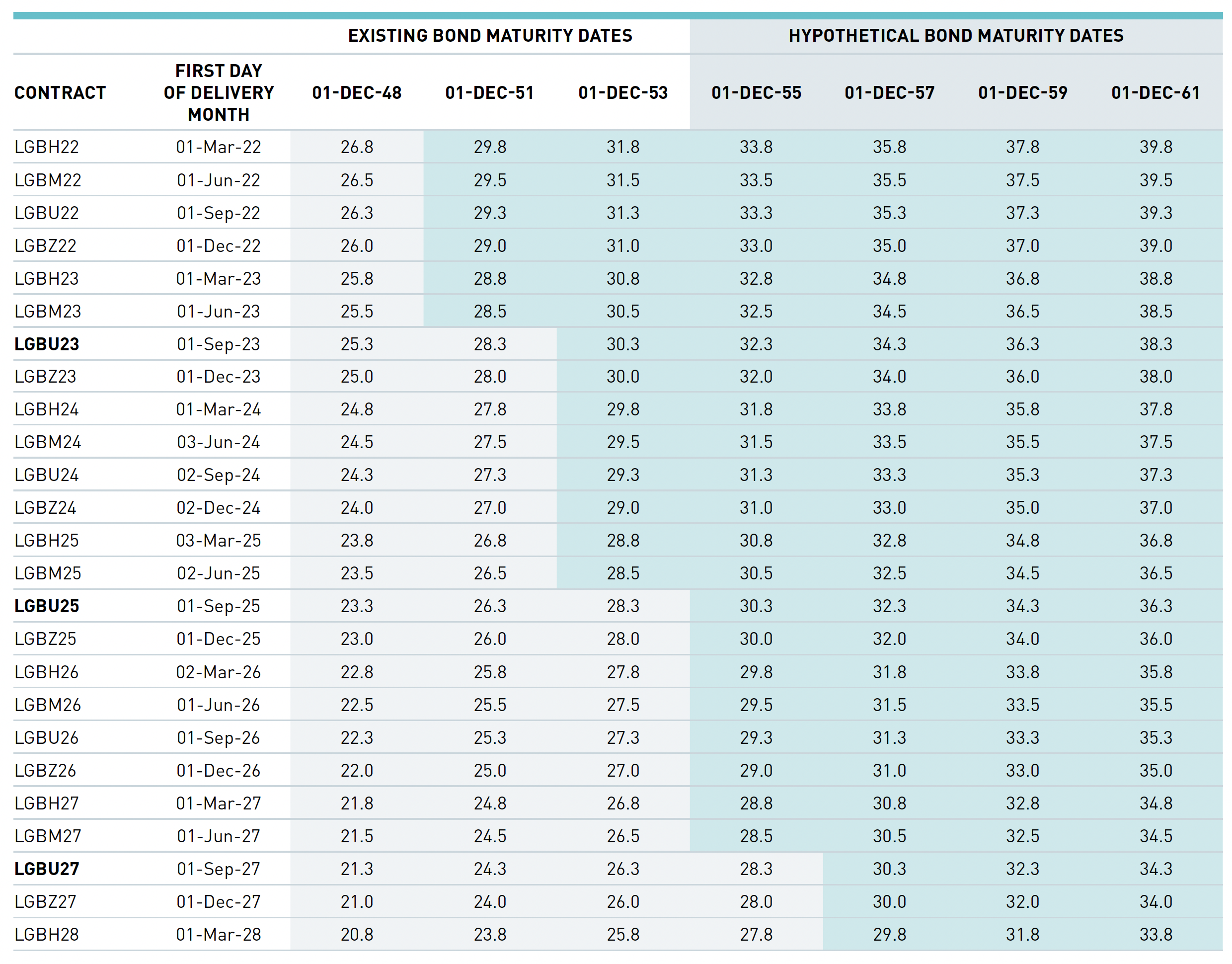

Although we cannot anticipate the funding needs of the federal government, especially at this time, we have continued the existing policy into the future to create Figure 1 which calculates the term to maturity of existing and hypothetical Canadian long bonds and whether they will be eligible for delivery into LGB contracts. In this scenario, the LGB delivery basket will change every two years with 24 months between bond maturities, which is the current auction policy of the Bank of Canada. The next change in the basket (and cheapest-to-deliver) will be when the LGBM23 gives up active contract status to the LGBU23 in late May 2023. On that date, the cheapest-to-deliver will change from the December 2051 to the December 20534, an extension of two years. If funding policy is unchanged5, the event would repeat itself in May 2025 for the LGBU25 contract and again in May 2027 for the LGBU27 contract.

FIGURE 1

A two-year extension in the CTD and the resulting extension of DV01 and maturity of the CTD for the contract will probably result in volatile rolls between June and September LGB contracts, much like the roll from June to September contracts in CGB created volatility and opportunities6, except with less frequency and perhaps more impact. Assuming no change in yields or the yield curve between late 2021 and the May 2023 roll period7, the DV01 difference between the LGBM23 and LGBU23 would be almost 5.5 cents8, or an extension of 12%.

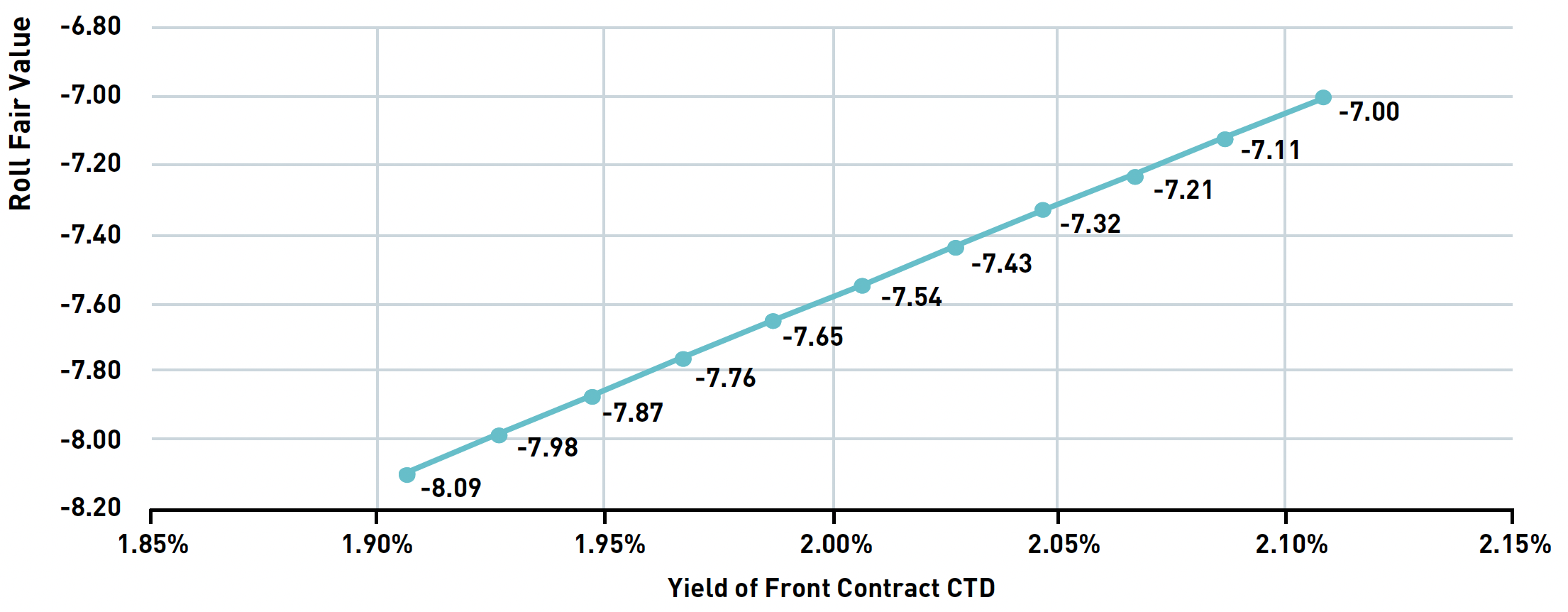

Figure 2 demonstrates one reason why rolling between contracts with a large difference in DV01 can result in volatile roll periods. As the level of yields changes, the fair value of the roll changes rapidly so investors that like to set a fair value bid or offer and wait for the market to come to them cannot really do so as the fair value fluctuates throughout the day with every change in yield. As illustrated, a range of 20 basis points (unlikely but not impossible) on the day can change the fair value of the roll between LGBM23 and LGBU23 by over a dollar. The same analysis for CGBM21/U21 was a change of just 40 cents for the roll on a DV01 extension of 19%. Managers that can profit from volatility will likely enjoy the June roll in LGB every couple of years.

FIGURE 2

LGBM23/LGBU23 Roll Fair Value v. Rate Level, May 25/23

(illustrative of the May 2023 roll period)

5 cents Minimum Price Fluctuation

The LGB has a minimum price increment of five cents per contract versus one cent per contract on CGB. For frequent traders of futures, this may seem like a large difference but for investors with experience in trading the long end of the Canadian yield curve, larger bid/offer relative to 10-year bonds will appear normal. In fact, when restated in basis points, the one cent price increment on a CGB contract is equal to 0.083 basis points while the five cents increment on LGB is equal to about 0.1 basis point due to the much larger DV01 of the LGB contract (more on this below). The net of the above is that LGB trading will be slightly more expensive than CGB transactions at the minimum price increment; trading LGB will be like trading CGB with a 1.2 cent minimum bid/ask spread.

Implied 6% Coupon Rate & Follow-On Effects

Just like CGB, the LGB contract has an implied 6% coupon rate for the contract when the delivery specifications are established. However, for LGB, the effects of this calculation may have surprising implications for some investors.

Very Low Conversion Factors

The first, and most important, aspect of using an implied 6% coupon rate to calculate conversion factors when yields are currently around 2% is that the conversion factors for deliverable bonds will initially be very low. In fact, the cheapest-to-deliver bond for the LGBH22 contract will have a conversion factor of just 0.4481, well below the "normal" conversion factors for CGB, which have been around 0.65 to 0.70 in recent years.

Very High DV01

Following from the very low conversion factors for deliverable bonds on LGB contracts, the DV01 of the contract will be extremely high. If we make the safe assumption that the current cheapest-to-deliver bond is highly likely to remain the CTD, the DV01 of the contract will be the DV01 of the CTD divided by the conversion factor. For the LGBH22 contract, the DV01 would be around 50 cents, which is more than double the DV01 of the longest maturity Canada 30-year bond, fourfold the DV01 of the CGB contract, almost 60% higher than the Canada ultra-long 2064 bond, and 40% higher than the Ultra 30-year US Treasury contract that trades on CME9.

Very High Contract Prices

Since the conversion factor for the cheapest-to-deliver bond is linked to the value of the contract and of the deliverable bond at expiry, normal futures basis levels will result in extremely high prices for the contract. In fact, the LGBH22 contract would trade at a price of almost $220 given current interest rate levels – truly atypical given that none of the bonds in the long end of the yield curve trade over $150 currently. Beware of fat-finger order entry errors on the first figure of the handle and/or set your software up to catch them!

Low Switch Risk

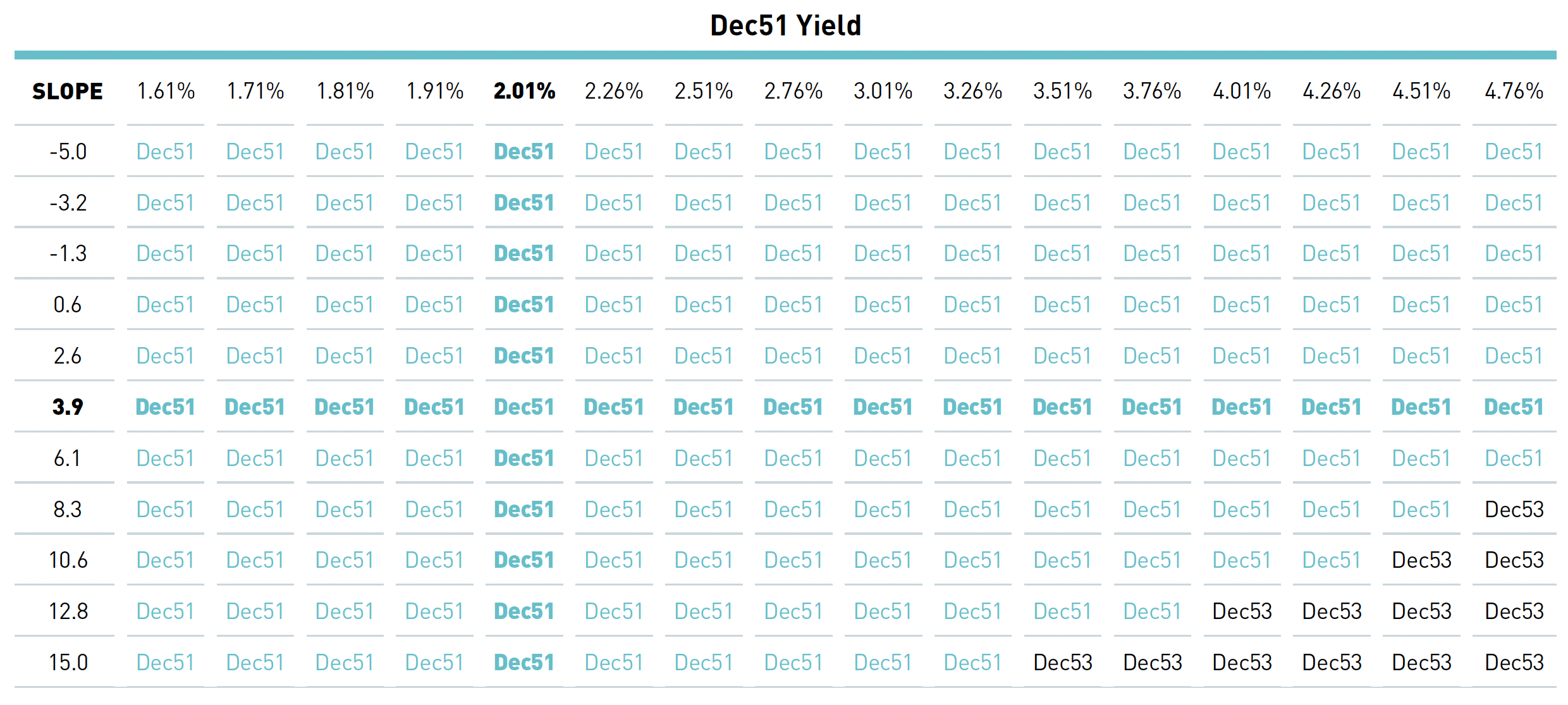

As CGB investors know, CTD math favors bonds with higher coupons and shorter maturities at yield levels under 6%. Initial contracts in LGB will almost certainly have little or no switch risk as the 2051 bond has a 2% coupon, higher than the 1.75% coupon on the 2053. Figure 3 shows the combination of yield and slope levels that would result in a switch of CTD from 2051 to 2053.

FIGURE 3

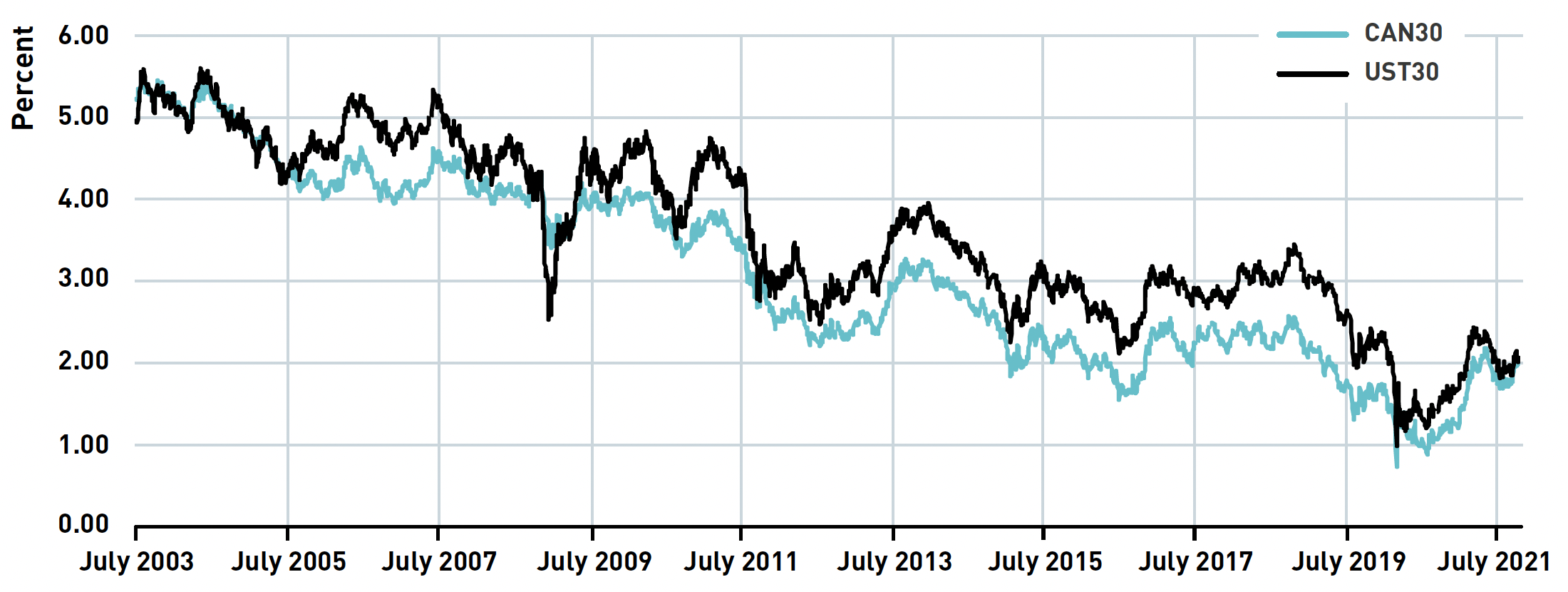

It would take a rise in yields of at least 200 basis points (very unlikely) and a steepening of the long end of the curve by 12 basis points (even more unlikely, given that the spread between benchmark 30-year bonds and auction bonds is rarely higher than a handful of basis points, and the spread tends to decline when yields are higher) to force the 2053 into CTD status. Given that Canadian and US long term interest rates have not seen levels approaching 5% for about 15 years, as shown in Figure 4, we can be nearly certain that a CTD switch is not going to happen for the LGB contracts. Switch risk in LGB contracts can probably be safely ignored for now and will probably price at zero or almost zero value.

FIGURE 4

Canada & US 30Y Constant Maturity Bond Yield

Source: BMO Capital Marketsi Fixed Income Sapphire database, Montréal Exchange

Valuable Wildcard Options?

Another aspect of the LGB contract driven by very low conversion factors is the valuation of the embedded Wildcard option10. Low conversion factors mean an investor that is long the LGB futures basis (short LGB, long Canada 2051 bonds) would hold 223,000 face value of bonds to equal the DV01 of a single LGB contract. If delivery took place, the investor would have a gigantic hedge tail of $120,000 bonds to sell – presumably at a profit if the delivery was associated with a Wildcard exercise. The hedge tail, or leftover bonds after delivery, is larger with smaller conversion factors11 so Wildcard exercise in LGB can be far more profitable than in contracts with larger conversion factors and smaller hedge tails, such as the 2-year (CGZ), 5-year (CGF) and 10-year (CGB) Canadian bond futures contracts.

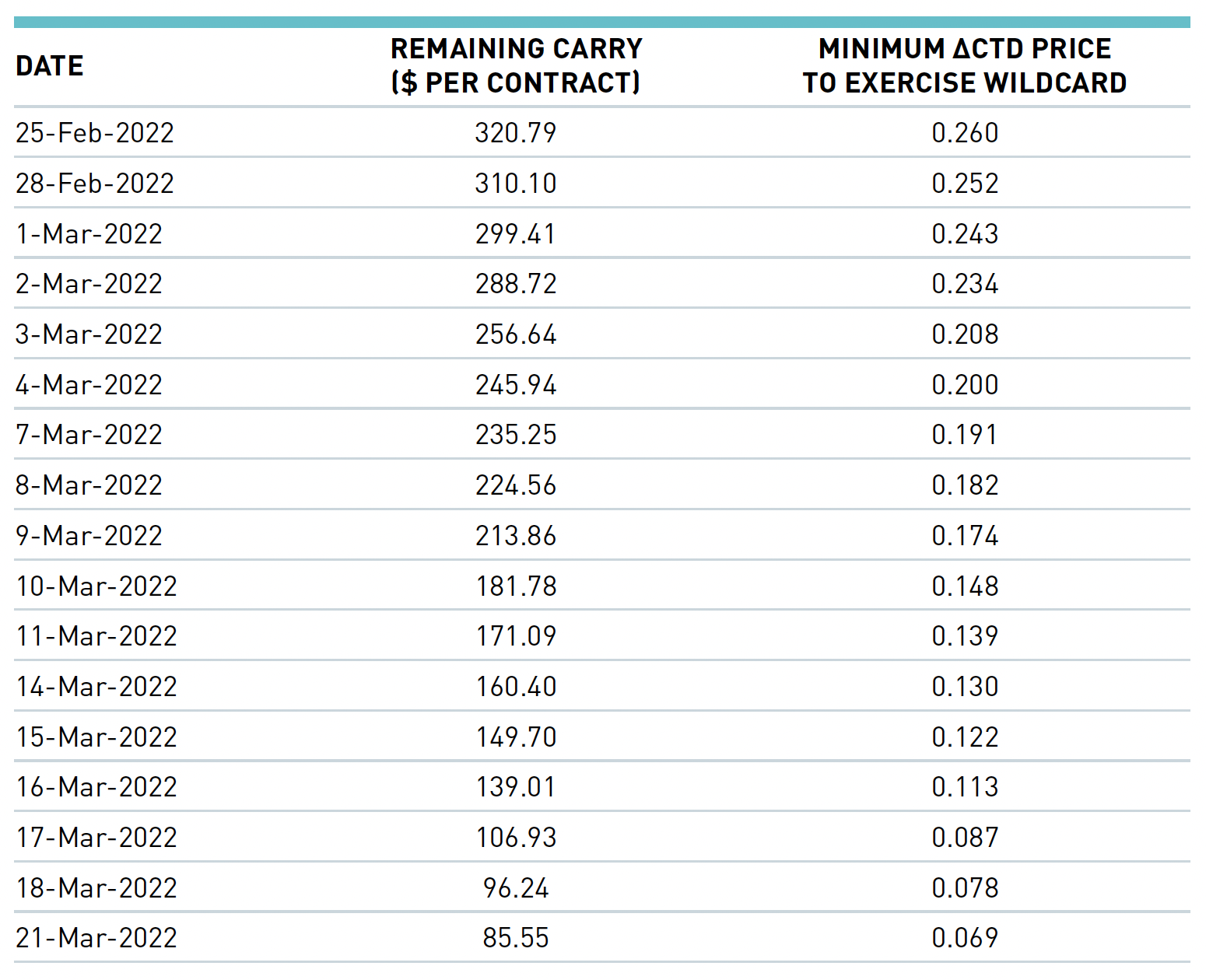

Potential profit via a Wildcard exercise can only be realized if the price of long bonds moves after 3pm and before 5:30pm12 due to the nature of this short-lived option. As a theoretical exercise, we calculate the minimum price increase required in the Canada 2% Dec 2051 bond after 3:00pm but before 5:30pm, when delivery notice must be made, for a Wildcard exercise to be profitable13 during the March delivery period for LGBH22. Of course, the carry per day during delivery will depend on yields and the implied repo rate of the contract which are unlikely to be the same in March 2022 as they are today. Nonetheless, the threshold is shown in Figure 5 and depicts a price change of 26 cents at the start of the delivery period, which declines to about 7 cents on the second-to-last business day before delivery.

FIGURE 5

LGBH22 Wildcard Treshold

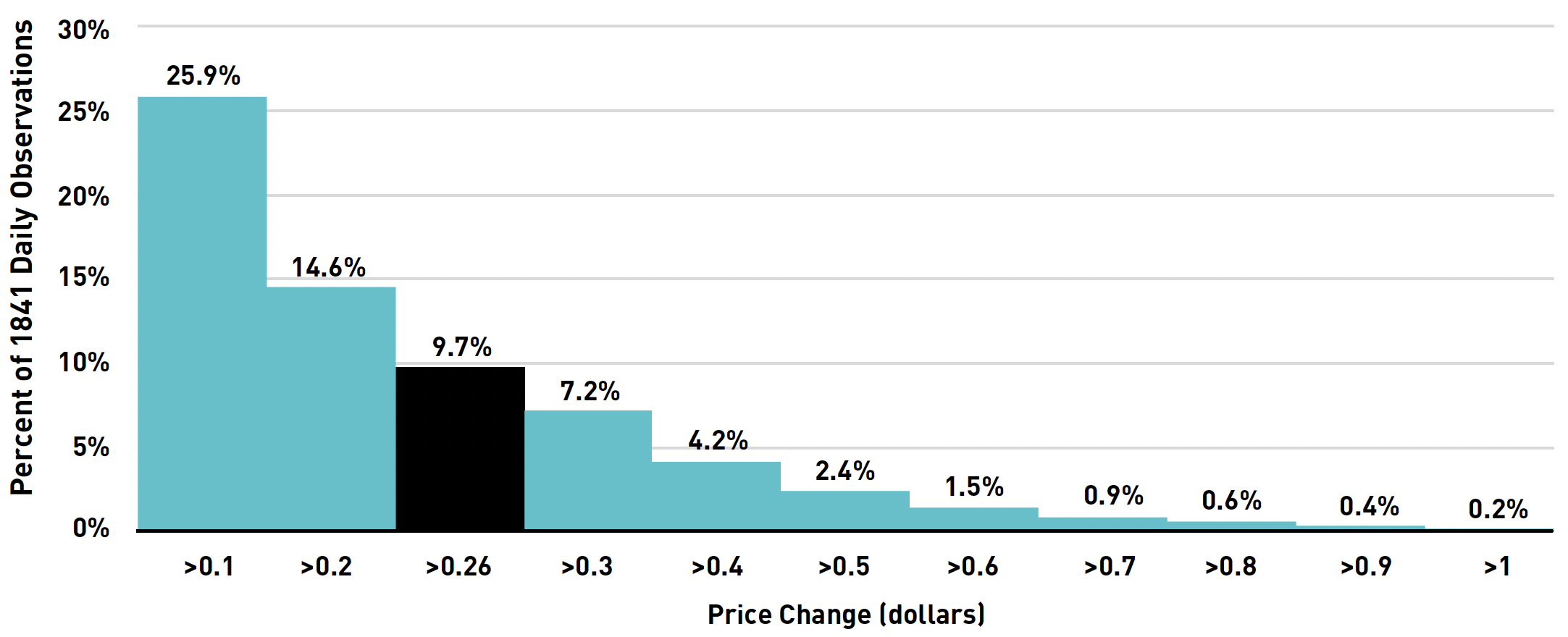

In long bonds, this 26-cent threshold is not insurmountable. In this case, 26 cents is a little over a basis point since the 2051s have a DV01 of about 23 cents. To obtain a sense of how often the price of long bonds increases by the amounts in Figure 5, we measured the price change recorded between 3pm and 5pm for the Canada 2048 bond, which has a much longer price history than the newer 2051 bond. Figure 6 shows that price changes of this magnitude occur quite often; about 10% of the time in the data set we used which covers just over seven years from mid-2014 to October 2021. If this data holds true14, one can expect a lot of potential value to the Wildcard option in the price of the LGB contract.

FIGURE 6

Can 2.75% December 2048 Bond Price Changes Between 3pm and 5pm (ET)

Source: BMO Capital Marketsi Fixed Income Sapphire database, Montréal Exchange

Summary

In summary, although the 30-year LGB contract shares almost all characteristics of the 10-year CGB contract, investors should be aware of some potential differences that may be important to them when trading LGB, depending on their investment guidelines and style of trading.

For more information, sign up to receive the latest news and updates or contact us.

1 For example, a scenario where bank dealers decide to switch to a new benchmark long bond when the current benchmark still has a term to maturity of greater than 28.5 years.

2 A less frequent, but very plausible, scenario where the Bank of Canada has changed issuance policy to extend the difference between long bond maturity dates.

3 The first LGB contract on which the new market making program will apply is the March 2022 expiry.

4 These statements assume the status quo, for the most part. Many unknowable factors will affect the calculation of cheapest-to-deliver bond for LGBU23 such as interest rate levels, slope of the yield curve, and long bond issuance/buybacks.

5 If the Bank moves back to maturity dates three years apart due to less funding requirements post-pandemic, the delivery basket change would be delayed a year.

6 For more on this topic, although no longer as applicable to CGB, please refer to "Jun/Sep CGB Roll: A Roll Unlike the Others" published by Montréal Exchange in April 2021.

7 The DV01 extension will be large regardless of interest rates level so the interest rate and slope assumptions aren't actually very important.

8 In this article, DV01 measures are expressed per $100 nominal value.

9 For purposes of comparison and representativeness, the DV01 of the Ultra 30-year US Treasury contract was measured in USD and not converted to Canadian dollar equivalent.

10 For a fuller description of how a Wildcard option exercise works, refer to "CGB Case Study: Wildcard Option Exercise" published by Montréal Exchange in July 2019.

11 The hedge tail notional is equal to [(1/conversion factor) – 1] x $100,000 per contract.

12 All times referred to in this article are representative of Eastern Time (ET).

13 The Wildcard option holder should not exercise if greater profits can be obtained by holding the short basis position to the final delivery date because the short basis position cannot do both – s/he forgoes the remaining positive carry in order to exercise the Wildcard.

14 It is possible, and even plausible, that almost no trading of long bonds takes place in the late afternoon. Closing price marks could have been recorded with little or no actual trading and bid/ask could be quite large late in the day making Wildcard exercise and the sale of the hedge tail unattractive or risky in practice. Additionally, the existence of short basis positions in the LGB contract during the delivery period should create a dampening effect and reduce the magnitude of late day price changes.

About the author:

Kevin Dribnenki

Kevin Dribnenki writes about fixed income derivatives and opportunities in Canadian markets. He spent over 10 years managing fixed income relative value portfolios as a Portfolio Manager first at Ontario Teachers' Pension Plan and then BlueCrest Capital Management. During that time he managed domestic cash bond portfolios as well as international leveraged alpha portfolios and has presented at several fixed income and derivatives conferences. He received a BA in Economics from the University of Victoria, an MBA from the Richard Ivey School of Business, and holds the Chartered Financial Analyst designation.Follow Kevin on LinkedIn

i BMO Capital Markets is a trade name used by BMO Financial Group for the wholesale banking business of Bank of Montreal, BMO Harris Bank N.A. (member FDIC), Bank of Montreal Ireland plc., and Bank of Montreal (China) Co. Ltd and the institutional broker dealer businesses of BMO Capital Markets Corp. (Member SIPC) in the U.S., BMO Nesbitt Burns Inc. (Member Canadian Investor Protection Fund) in Canada and Asia and BMO Capital Markets Limited (authorized and regulated by the Financial Conduct Authority) in Europe and Australia. "BMO Capital Markets" is a trademark of Bank of Montreal, used under license.

Copyright © 2021 Bourse de Montréal Inc. All rights reserved. Do not copy, distribute, sell or modify this document without Bourse de Montréal Inc.'s prior written consent. This information is provided for information purposes only. Neither TMX Group Limited nor any of its affiliated companies guarantees the completeness of the information contained in this publication, and we are not responsible for any errors or omissions in or your use of, or reliance on, the information. This publication is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice. The information provided is not an invitation to purchase securities or derivatives listed on Montreal Exchange, Toronto Stock Exchange and/or TSX Venture Exchange. TMX Group and its affiliated companies do not endorse or recommend any securities referenced in this publication. LGB, CGB, Montréal Exchange and MX are the trademarks of Bourse de Montréal Inc. TMX, the TMX design, The Future is Yours to See., and Voir le futur. Réaliser l'avenir. are the trademarks of TSX Inc. and are used under license.